NRS & SIRS Approved Platform

NRS & SIRS Approved PlatformSimplifying Tax Filing

for Nigerians —

Corporate & Individual

File and pay your taxes online in minutes. Integrated with NRS, Remita, Paystack & Flutterwave.

10-minute filing

10-minute filing Bank-grade security

Bank-grade security Instant TCC download

Instant TCC download

How It Works

File your taxes in four simple steps. From registration to certificate

download, the entire process takes less than 10 minutes.

Sign In

Corporate Email or TIN

Quick registration with your business email or Tax Identification Number

File Returns

Upload payroll or enter income details

Simple forms with auto-calculation and validation

Pay Online

Pay securely via Remita, Paystack, or Flutterwave

Multiple payment options for your convenience

Download Certificate

Get your official TCC instantly

Immediate download of tax clearance certificate

Features for Everyone

Whether you're filing for your business or personal taxes, we have the right

tools to make the process seamless.

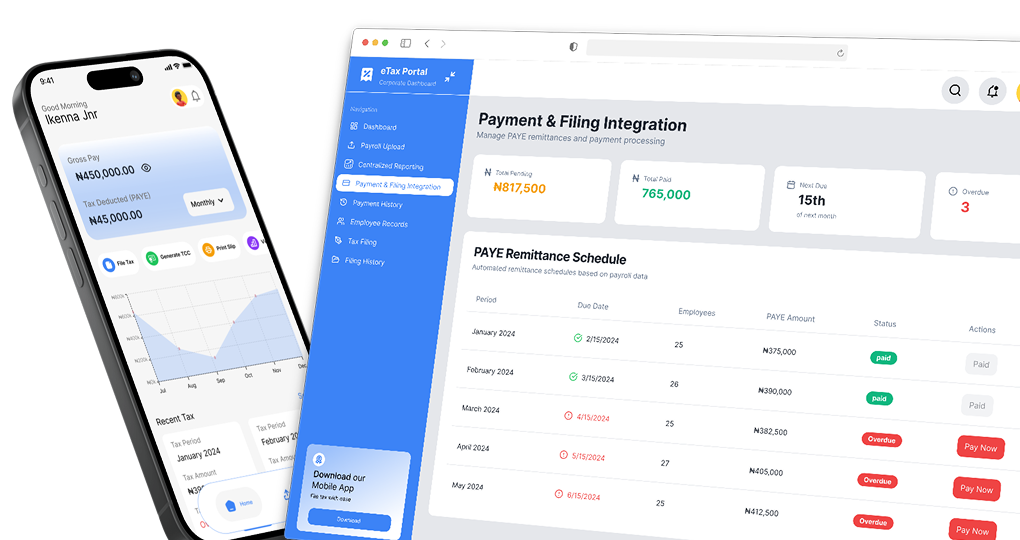

Bulk Payroll Upload & Auto Tax Calculation

Streamlined for business operations with enterprise-grade security and compliance.

Government-Compliant PAYE Reports

Streamlined for business operations with enterprise-grade security and compliance.

Direct Filing to NRS + Payment

Streamlined for business operations with enterprise-grade security and compliance.

Employee Tax Records Management

Streamlined for business operations with enterprise-grade security and compliance.

Multi-branch Management Support

Streamlined for business operations with enterprise-grade security and compliance.

Automated Compliance Notifications

Streamlined for business operations with enterprise-grade security and compliance.

Why Choose OH-Res e-Tax?

Join thousands of Nigerians who have simplified their tax filing process with our trusted, government-approved platform.

Fast & Automated

No more manual forms

Our intelligent system automates calculations, validates data, and processes your filing in minutes, not hours.

100% Compliant

Accepted by NRS/SIRS

All filings are fully compliant with Nigerian tax regulations and directly integrated with government systems.

Secure & Transparent

Encrypted and clear tax breakdowns

Bank-grade encryption protects your data while providing clear, detailed breakdowns of all tax calculations.

Trusted Partners & Integrations

FAQ

Frequently asked questions

Explore our frequently asked questions to learn more about OH-Res’s features, security, integration capabilities, and more

Both companies and individuals can use it. Companies use the Corporate Dashboard to file and remit PAYE for employees, while freelancers and self-employed individuals use the Individual Dashboard to file personal income tax.